About Job

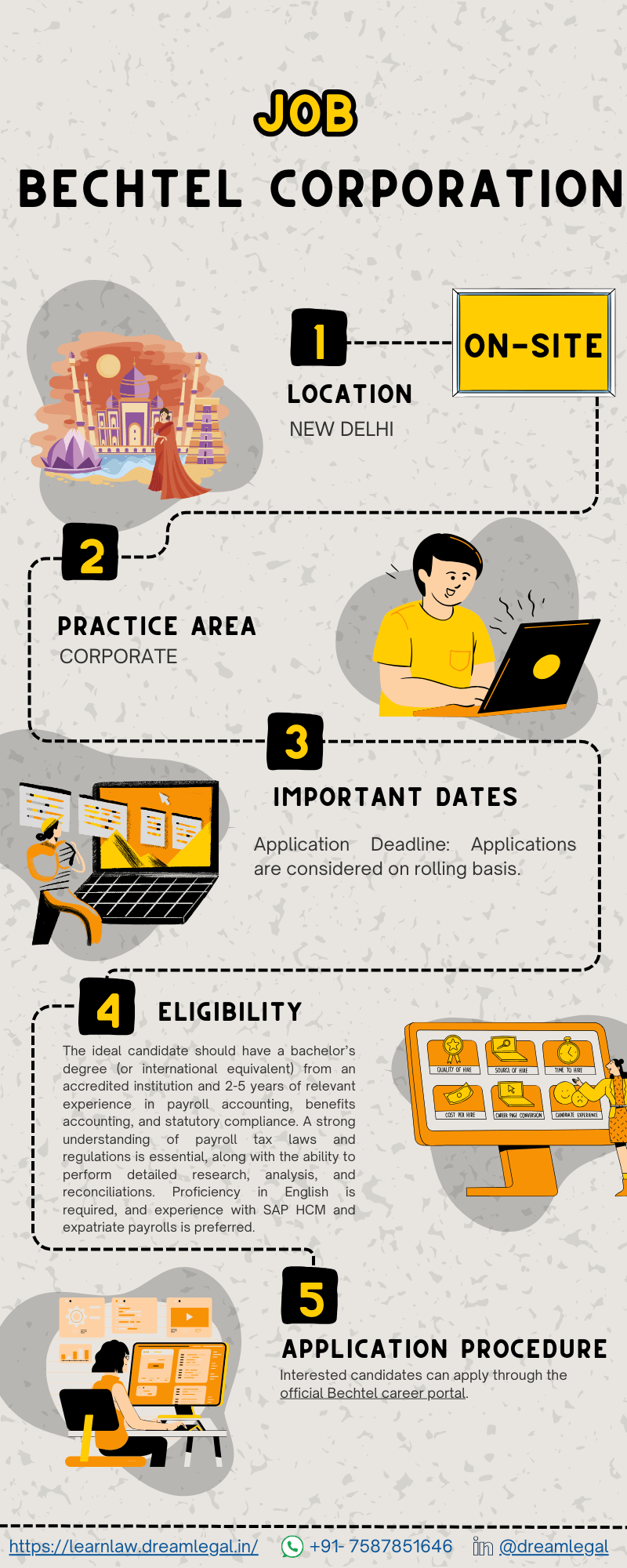

Bechtel Corporation in New Delhi is looking for candidates for the position of Payroll Tax Compliance Analyst position a critical role within the Bechtel Business Services (BBS) team. The role involves managing payroll tax compliance for both domestic and international operations, ensuring that all payroll tax calculations and benefit calculations are accurate and compliant with local, federal, and international regulations. This position requires collaboration with various departments, including payroll, state tax offices, and human resources.

About Organization

Bechtel Corporation is one of the world’s leading engineering, construction, and project management companies. With a legacy of delivering some of the most complex and impactful projects globally, Bechtel is known for its commitment to excellence and innovation. The company operates across a wide range of industries, including infrastructure, mining, energy, and defense. Bechtel’s Business Services (BBS) provides high-quality services in finance, human resources, and corporate systems to support its global operations.

Eligibility

The ideal candidate should have a bachelor’s degree (or international equivalent) from an accredited institution and 2-5 years of relevant experience in payroll accounting, benefits accounting, and statutory compliance. A strong understanding of payroll tax laws and regulations is essential, along with the ability to perform detailed research, analysis, and reconciliations. Proficiency in English is required, and experience with SAP HCM and expatriate payrolls is preferred.

Role and Responsibilities

The primary responsibilities include performing detailed analysis and reconciliation of payroll tax balances, auditing income tax returns and unemployment tax returns, and ensuring compliance with local, federal, and international payroll tax regulations. The role also involves maintaining state unemployment rate information, auditing international payroll taxes, and responding to general ledger balance inquiries. The analyst will be responsible for setting up new tax general ledger accounts and ensuring compliance with telework regulations, including taxes and workers’ compensation.

Perks

Bechtel offers a comprehensive benefits package designed to support the well-being and career growth of its employees. This includes competitive compensation, opportunities for professional development, and programs to enhance the company’s inclusive culture. Bechtel is committed to providing an environment where employees can thrive and contribute to the company’s legacy of sustainable growth.

Mode and Location

This is a full-time, on-site position based in New Delhi, with the option for part-time telework. The role offers a balance of on-site and remote work to accommodate various work preferences.

Application Procedure

Interested candidates can apply through the official Bechtel career portal. Ensure that your application highlights your experience in payroll tax compliance, your familiarity with payroll tax laws, and your ability to work effectively in a cross-functional team.

Important Dates

Application Deadline: Rolling basis.

Official Link

For more information and to apply for the job refer to official Bechtel career portal.

Check out for more: