About Job

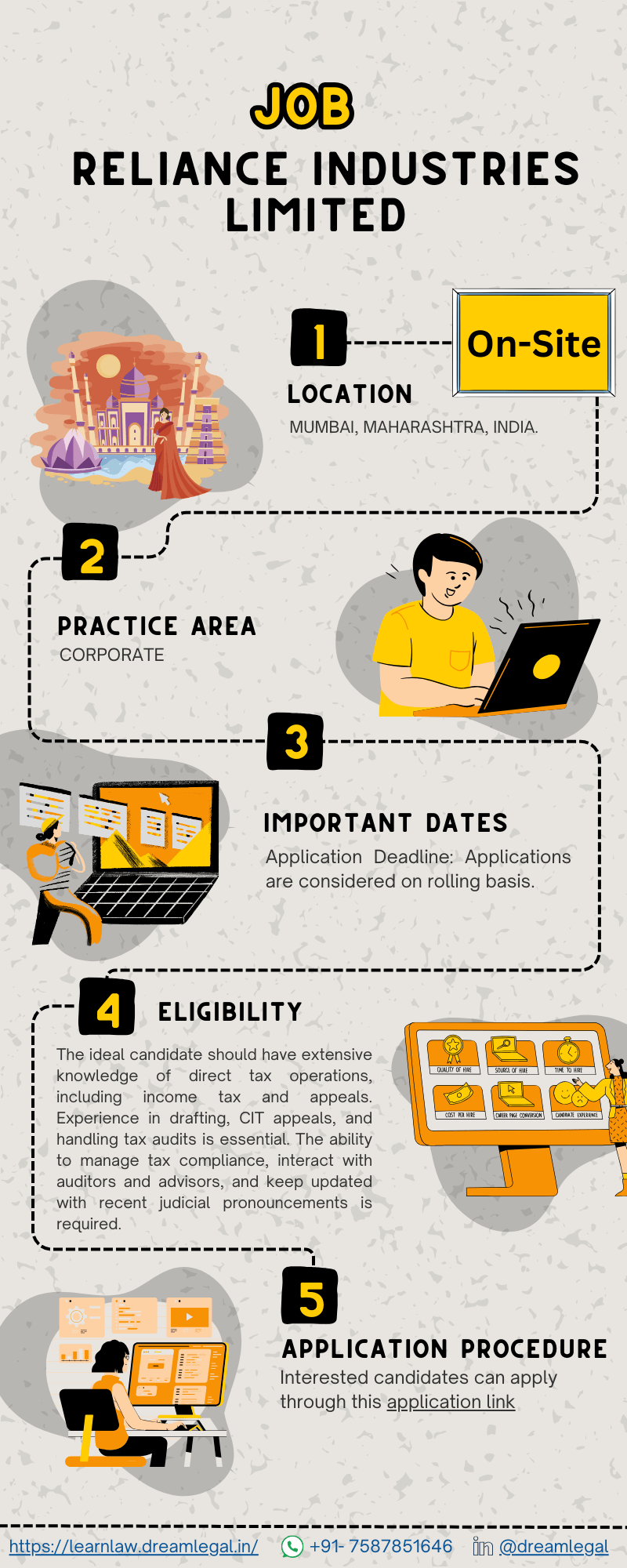

Reliance Industries Limited is providing Direct Taxation position requires a candidate well-versed with the Income Tax Act and Double Taxation Avoidance Agreements (treaties). Basic knowledge of Transfer Pricing provisions and rules will be an added advantage. The role involves ensuring compliance with statutory and regulatory requirements, handling tax audits, filing tax returns, and coordinating details for tax filings, computations, and audits.

About organization

Reliance Industries Limited is a Fortune 500 company and the largest private-sector corporation in India. The company operates in various sectors including petrochemicals, refining, oil, telecommunications, retail, and digital services. Headquartered in Mumbai, Maharashtra, Reliance Industries is known for its innovation and significant contributions to India’s economic growth.

Eligibility

The ideal candidate should have extensive knowledge of direct tax operations, including income tax and appeals. Experience in drafting, CIT appeals, and handling tax audits is essential. The ability to manage tax compliance, interact with auditors and advisors, and keep updated with recent judicial pronouncements is required.

Role and responsibilities

– Ensure compliance with statutory and regulatory requirements.

– Handle tax audits and file tax returns independently.

– Review and coordinate details for tax filings, tax computations, tax audits, and other tax compliances.

– Prepare and review details for scrutiny assessments and represent before assessing authorities.

– Draft requisite submissions for filing before tax authorities and respond to notices timely.

– Collate and review data for tax appeals at various stages.

– Draft submissions for appeals, both factual and legal.

– Interface with various departments and group companies for tax matters.

– Interact with auditors and advisors to resolve queries on tax matters.

– Brief Counsel/Sr. Counsels before hearings.

– Collate, review data, file lower withholding tax orders, and follow up for the same.

– Prepare and follow up for Tax Residency Certificates.

– Review advance tax working on a quarterly basis and provision for tax.

– Follow up on the status of Income Tax assessment, tax refunds, and filing of rectification applications.

– Review and update the tax status charts and contingent liability charts regularly.

– Keep track of all notices and hearings.

– Draft appeals before CIT(A), ITAT, and review appeals to be filed before High Court & Supreme Court.

– Provide proactive and timely responses to queries raised by business teams.

– Update teams on recent changes in the law and keep updated with recent judicial pronouncements at various courts.

Perks

– Competitive salary ranging from ₹2.2M/yr to ₹2.7M/yr.

– Opportunity to work on-site at the Reliance Industries Limited office in Mumbai.

– Be a part of a leading corporation with significant industry impact.

– Networking opportunities with experienced professionals.

Mode and Location

This is a full-time, on-site position based in Mumbai, Maharashtra, India.

Application Procedure

Interested candidates can apply through this application link . Ensure to submit all necessary documents and information as required by the application form.

Important Dates

Applications are considered on rolling basis.

Official Link

To apply for this position and for more details, please visit the application link or refer to RIL’s LinkedIn page.

Check out for more: