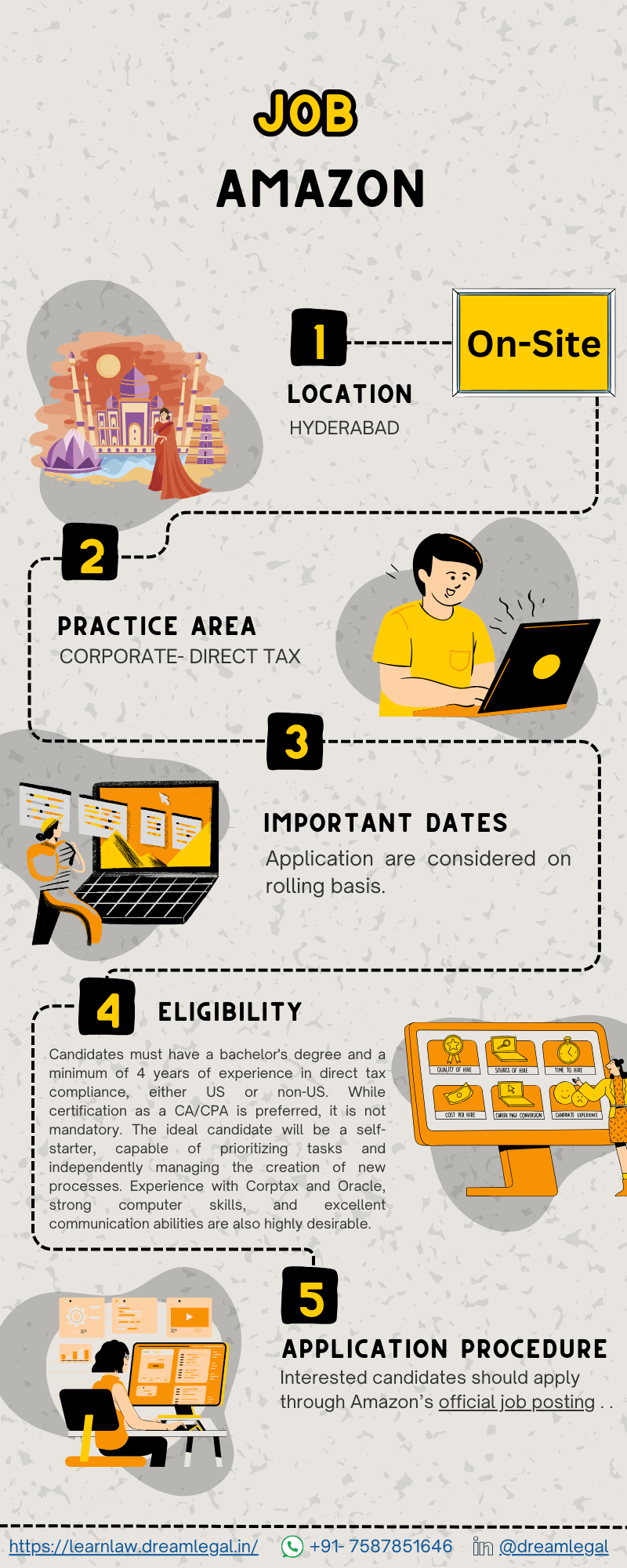

About the Job

Amazon is looking for a Foreign Tax Analyst to join its Direct Tax Reporting team in Hyderabad, India. This role is ideal for professionals interested in a fast-paced, team-oriented environment. The selected candidate will be responsible for supporting various aspects of the foreign reporting team, including process simplification, coordination with stakeholders, and preparation of compliance deliverables for manager review. Additionally, the role involves working on multiple process simplification projects, making it a dynamic and evolving position.

About the Organisation

Amazon, one of the world’s largest and most customer-centric companies, is known for its innovative approach to business and technology. The company operates across a wide range of industries, including e-commerce, cloud computing, and digital streaming. With its commitment to excellence and continuous improvement, Amazon offers a unique environment for professionals looking to grow and make a significant impact.

Eligibility

Candidates must have a bachelor’s degree and a minimum of 4 years of experience in direct tax compliance, either US or non-US. While certification as a CA/CPA is preferred, it is not mandatory. The ideal candidate will be a self-starter, capable of prioritizing tasks and independently managing the creation of new processes. Experience with Corptax and Oracle, strong computer skills, and excellent communication abilities are also highly desirable.

Role and Responsibilities

The Foreign Tax Analyst will have a diverse set of responsibilities, including:

– Preparing local tax provisions for Amazon entities or geographies assigned under US GAAP, IFRS, or local GAAP. This includes current and deferred tax calculations, disclosures, and journal entries for interim and year-end financial statements.

– Developing, implementing, and documenting standard procedures for tax compliance and reporting processes.

– Preparing Foreign Corporation Tax Returns, other tax filings, and supporting work papers.

– Preparing estimated installment payment calculations.

– Extracting, analyzing, and reviewing data to make appropriate recommendations.

– Supporting audit queries with necessary data and information by extracting from various tools and sources.

– Assisting with process improvements and automation implementation throughout the foreign tax reporting and compliance process.

Perks

Working at Amazon offers numerous perks, including:

– The opportunity to work in a dynamic and fast-paced environment.

– Exposure to global tax compliance processes and systems.

– The chance to be part of a leading company that values innovation and excellence.

– Competitive compensation and benefits.

– Opportunities for career growth and development within Amazon’s expansive network.

Mode and Location

This is a full-time, on-site position based in Hyderabad, India. The role is part of Amazon’s Finance and Global Business Services, specifically within the Tax department.

Application Procedure

Interested candidates should apply through Amazon’s official job posting . Make sure to include your updated resume and highlight relevant experience in tax compliance, process improvement, and the use of tax software such as Corptax and Oracle.

Important Dates

The application process is ongoing, so interested candidates are encouraged to apply as soon as possible.

Official Link

For more details and to apply, please visit Amazon’s official job posting.

Check out for more:

Associate/Senior Associate Vacancy at J. Sagar Associates (JSA)