About the Job

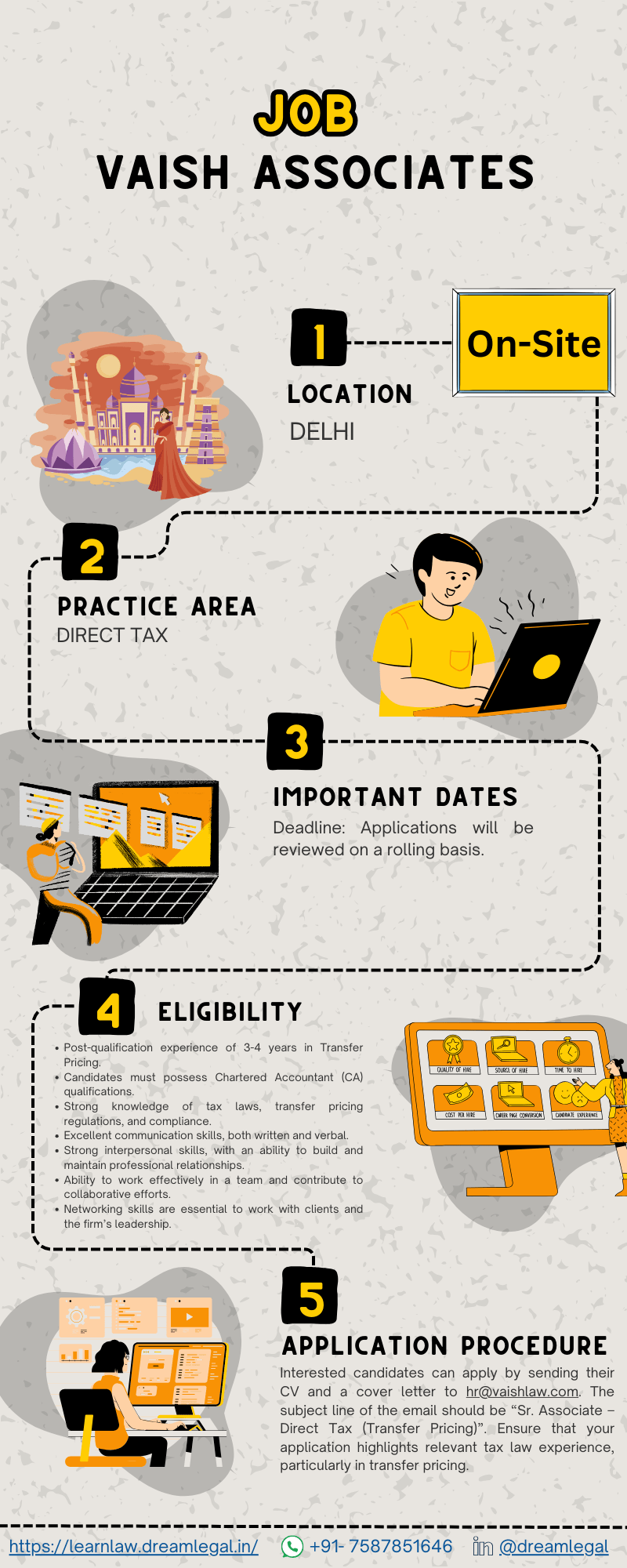

Vaish Associates Advocates is inviting applications for the role of Senior Associate in their Direct Tax (Transfer Pricing) team, based in New Delhi. The role focuses on legal and advisory aspects of transfer pricing, and involves working closely with partners and team members to handle complex tax-related issues. The position is ideal for experienced tax professionals seeking to expand their expertise in transfer pricing and related matters.

About the Organisation

Vaish Associates Advocates is a premier law firm in India, recognized for its comprehensive legal services across multiple practice areas, including taxation, corporate law, M&A, and intellectual property. With decades of experience, Vaish Associates is known for delivering top-notch legal counsel to clients ranging from multinational corporations to government bodies. Their Direct Tax team is well-regarded for its proficiency in tax litigation and advisory, including transfer pricing, international taxation, and compliance.

Eligibility

- Post-qualification experience of 3-4 years in Transfer Pricing.

- Candidates must possess Chartered Accountant (CA) qualifications.

- Strong knowledge of tax laws, transfer pricing regulations, and compliance.

- Excellent communication skills, both written and verbal.

- Strong interpersonal skills, with an ability to build and maintain professional relationships.

- Ability to work effectively in a team and contribute to collaborative efforts.

- Networking skills are essential to work with clients and the firm’s leadership.

Role and Responsibilities

The key responsibilities of the Sr. Associate (Direct Tax – Transfer Pricing) role include:

- Drafting appeals and stay applications for filing before the Tribunal.

- Drafting objections for the DRP (Dispute Resolution Panel).

- Drafting submissions/replies to show cause notices.

- Attending hearings before the Transfer Pricing Officer (TPO).

- Preparing appeals for filing before the High Court.

- Preparing TP studies, reviewing comparables, and benchmarking transactions.

- Filing forms in compliance with transfer pricing regulations.

- Preparing newsletters on transfer pricing updates.

- Creating presentations for internal office meetings and training on transfer pricing issues.

Perks

- The opportunity to work with industry leaders in tax law and transfer pricing.

- Exposure to complex tax cases and diverse clientele.

- Competitive salary and professional development opportunities.

- Collaborative work environment that encourages learning and growth.

Mode and Location

- On-site position at the New Delhi office of Vaish Associates Advocates.

- Regular coordination with clients and other team members for smooth operations.

Application Procedure

Interested candidates can apply by sending their CV and a cover letter to hr@vaishlaw.com. The subject line of the email should be “Sr. Associate – Direct Tax (Transfer Pricing)”. Ensure that your application highlights relevant tax law experience, particularly in transfer pricing.

Important Dates

Deadline: Applications will be reviewed on a rolling basis

Official Link

For more information on the role and the firm, visit Official LinkedIn Notification

Check out for more: